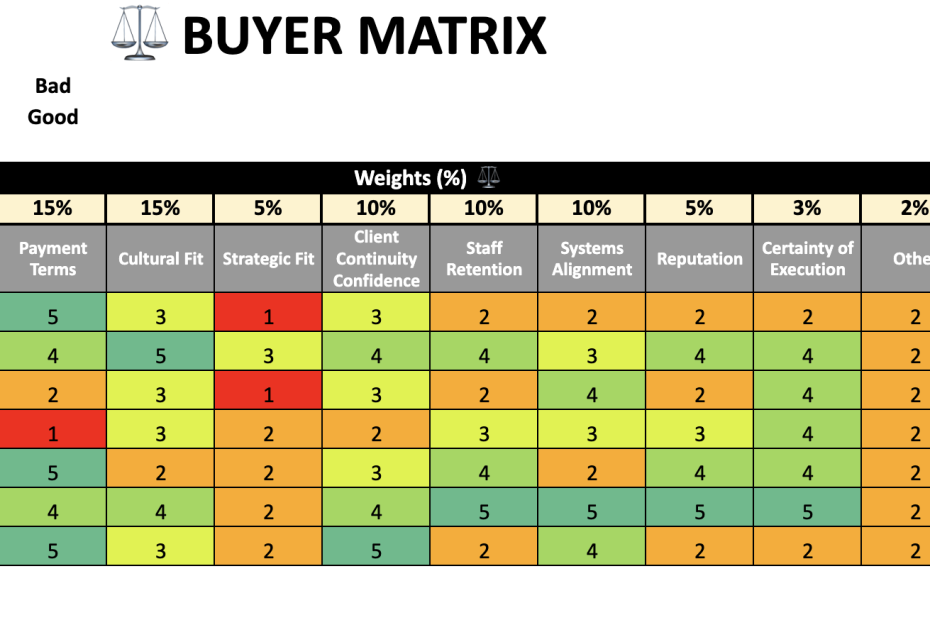

The Buyer Matrix: A Decision-Making Framework for Choosing the Right Acquirer

In the sale of a professional services firm, the moment that defines the future is not the signing of the contract — it is the selection of the buyer. For owners of financial planning and accounting practices, this decision carries implications far beyond the purchase price: client trust, staff continuity, cultural identity, and the trajectory of the firm’s legacy all hang in the balance.

Yet when multiple offers arrive — often with varied structures, personalities, and strategic narratives — sellers find themselves grappling with an unexpected challenge. The abundance of choice creates cognitive overload. High-intensity negotiations, asymmetric information, and competing priorities tend to distort decision-making.

At Growth Focus, we have observed this repeatedly across hundreds of transactions. What sellers need in these moments is not more spreadsheets, but a decision architecture that clarifies trade-offs and reduces noise. Enter the Buyer Matrix — a structured, weighted evaluation tool designed to help owners identify the acquirer most aligned with the outcomes they value.

Why Decisions Fail Without a Framework

Behavioural science tells us that complex, high-stakes decisions tend to be influenced by recency bias (“the last buyer seemed great”), anchoring (“they offered the highest number, so they must be the best”), and emotional heuristics (“I just like this team more”).

In professional services M&A, these cognitive shortcuts can be particularly dangerous because:

-

Price is not a proxy for success

Research into advisory firm transitions shows that cultural mismatch and poor strategic alignment account for the majority of post-sale client attrition — often dwarfing any price premium attained at completion. -

The costs of a wrong choice compound over time

A buyer who cannot retain staff, integrate systems, or uphold client experience can rapidly erode the very asset base underpinning the valuation. -

Owners underestimate long-term consequences

Unlike other industries, financial planning and accounting practices are relationship businesses; continuity and trust often outweigh transactional maximisation.

The Buyer Matrix counters these forces by making invisible considerations visible and comparable.

The Logic of the Buyer Matrix

The Buyer Matrix proposes a simple premise:

Not all factors matter equally — and not all buyers excel in the same areas.

Instead of evaluating offers sequentially (“Buyer A vs Buyer B”), the matrix reframes the decision horizontally, across multiple weighted dimensions that reflect what the seller actually values. Sellers assign weightings across factors such as:

-

Price

-

Payment terms

-

Cultural fit

-

Strategic alignment

-

Client continuity

-

Staff retention

-

Systems compatibility

-

Reputation and brand alignment

-

Speed and certainty of completion

These weightings inevitably differ from seller to seller. For one firm, staff retention may be the non-negotiable anchor. For another, speed and certainty of completion may outweigh everything else due to retirement timelines or risk tolerance.

This is the critical shift:

The Buyer Matrix prioritises the seller’s values, not the buyer’s narrative.

Step 1: Weight What Matters Most

Owners are asked to distribute 100 percentage points across the factors above.

This simple act forces clarity:

-

Is cultural alignment worth more than an incremental $200,000?

-

Should payment structure outweigh headline price?

-

How important is brand reputation in maintaining client trust?

By translating priorities into weightings, the matrix becomes a personalised valuation model — a decision engine rooted in the seller’s strategic intent.

Step 2: Score Each Buyer on a Five-Point Scale

Each buyer is then assessed objectively across the weighted factors:

-

5 = Excellent

-

4 = Strong

-

3 = Acceptable

-

2 = Weak

-

1 = Poor

Crucially, this scoring is not emotional; it is structured, comparative, and evidence-based.

A buyer offering the highest price may receive a 5 on financial terms but a 2 on cultural fit or a 3 on client continuity. Another buyer may have a slightly lower offer but a stronger operating model, higher retention metrics, or a superior service philosophy that aligns more closely with the seller’s vision.

Step 3: Let the Mathematics Reveal the Truth

When weightings and scores are multiplied, the matrix produces a total weighted score for each buyer. This provides an integrated assessment of the buyer’s fit — not just on paper, but across every dimension that drives long-term success.

In many cases, a surprising but important insight emerges:

The best buyer is not always the highest bidder.

It is the one who maximises overall fit.

We see this repeatedly: Buyer A offers the highest price, but Buyer B offers the greatest continuity for clients, the strongest team alignment, and the safest pathway to completion — resulting in a higher total weighted score.

In these instances, the matrix serves as a compass, not a calculator.

It shows sellers where their true north lies.

The Strategic Value of the Buyer Matrix

Beyond its immediate utility, the Buyer Matrix delivers three long-term benefits:

1. It protects the integrity of the transaction.

Choices made under pressure can create post-sale regret. A structured framework reduces emotional volatility and anchors decision-making in clear, rational criteria.

2. It aligns stakeholders.

Partners, spouses, boards, and advisers often have differing viewpoints.

The matrix provides a common language and shared evaluation model.

3. It creates a defensible decision trail.

If multiple strong buyers are involved, the matrix explains — transparently and logically — why a certain path was chosen.

Why This Matters in Today’s Market

As consolidation accelerates across the financial advice and accounting sectors, sellers face sophisticated acquirers with well-practised pitch narratives. The abundance of capital, private equity involvement, and shifting client expectations mean that choosing the right acquirer is no longer intuitive — it’s strategic.

The Buyer Matrix provides the structure required to make that strategy explicit.

Ask us for a copy of the Excel template

Growth Focus makes this framework available to sellers who want clarity during competitive processes. If you’d like a copy of the Buyer Matrix — or support applying it to your current offers — you can request access directly from our team.

SUBMIT FORM

to receive Buyer Matrix Excel